Returning to the Office – Q1 2024 Workplace Utilization Insights

Since 2020, the idea of the “office” or “workplace” has evolved dramatically. The rise of hybrid work has redefined where and what is required to drive employee productivity and efficiency, and as a result, challenges the organizations that own, plan, and manage office buildings, to innovate and adapt to these changing dynamics; or fall behind.

The “new normal” of the workplace

In this “new normal,” building owners around the world are still struggling to understand how they can use workplace utilization data to manage and optimize the spaces they own for gains in tenant productivity and efficiency.

The good news is that with a holistic approach to space management and planning, organizations can create highly effective and value-added spaces that surprise and delight their tenants, and ultimately, empower richer, healthier, and more productive office experiences.

Recent utilization data pulled across a global sample of R-Zero’s building intelligence sensor customers highlights some interesting takeaways indicative of how workplace preferences are changing in 2024.

Employee return to office trends upward in Q1 2024

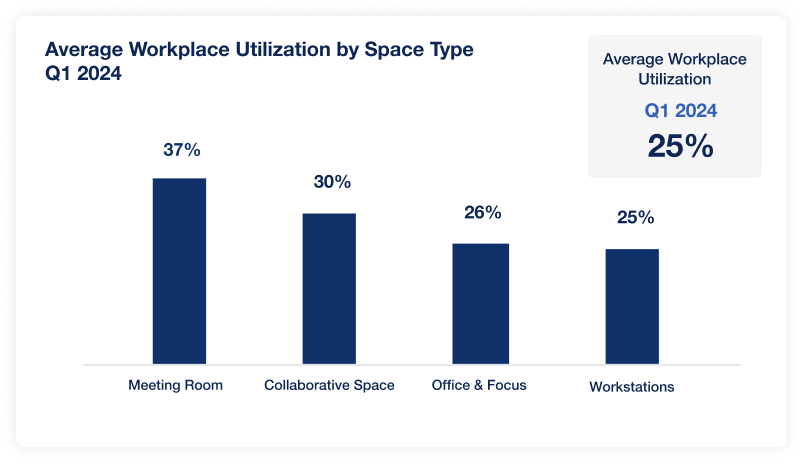

Average workplace utilization in Q1 shows a small increase across nearly all space types compared to Q4 2023, with the most significant gain in workstation activity, while office and focus space saw a dip in utilization. These changes in preference are likely attributed to new, more productive office layouts and more in-person collaboration, whereas in 2023, the common complaint was that people came to the office only to collaborate over video, in a focus space, or in a phone room. This data suggests a highly positive and anticipated transition.

Seat vacancies point to daily show-up rate

A 52% average seat vacancy rate in Q1 indicates that despite the increase in total utilization, only 48% of the seats provided to support work in office are used on a daily basis.

Considering that workers who genuinely spend time in the office (not those who coffee-badge) are likely to use 2+ seats daily, we can start to see a trend in daily show-up rates of half (or 26%) which is in line with the average 25% utilization figure noted above.

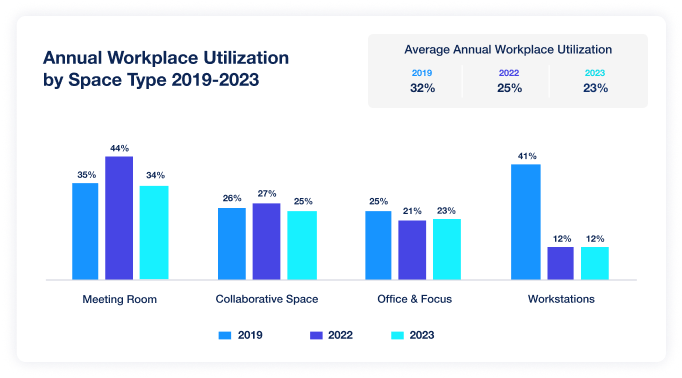

Annual utilization proves employees return to office time for collaboration

A pre- and post-pandemic snapshot of workplace utilization shows that workers remain consistent in their use of two types of spaces — collaborative spaces and enclosed or private focus spaces. Usage of conference and meeting rooms, which surged in 2022, is down to its pre-pandemic level of one-third of all space utilization.

Another notable data gap is the drop in workstation use, which began to rise again at the start of the year. This is likely due to the shifting ratio to more personal and collaborative spaces.

Download our Building Intelligence Index for more insights to optimize your spaces for workforce efficiency.

Learn more about how to use integrated building analytics to boost tenant experience and create energy-saving opportunities tailored to your spaces via our Building Intelligence Index.

More posts you might like

-

3 Key Takeaways from AHR Expo 2025: What’s Shaping the Future of HVAC

The 2025 AHR Expo brought together HVAC industry leaders, innovators, and professionals to showcase the latest advancements in heating, ventilation, and air conditioning. Here are the key insights that stood out from our team on the ground. 1. Smart Technology is Enhancing, Not Replacing, Traditional HVAC A significant shift observed at this year’s expo is […]

-

Webinar Recap: Redefining Energy Efficiency

As commercial energy costs continue to rise, building operators are looking for faster, cost-effective solutions to reduce waste and improve efficiency. Heating, Ventilation, and Air Conditioning (HVAC) systems account for nearly 60-70% of total building energy consumption, making them one of the largest opportunities for savings. However, traditional HVAC systems often operate on outdated schedules, […]

-

Wildfire Smoke: Understanding the Impact on Indoor Air Quality

As we face yet another intense wildfire season, with significant events already impacting regions across the country, the challenges to air quality, both outdoors and indoors, are more pressing than ever. Wildfires contribute up to 50% of “ultrafine” particles in the air; tiny pollutants that can travel hundreds of miles and infiltrate indoor spaces, affecting […]